ELECTRONIC ARTS (EA)·Q3 2026 Earnings Summary

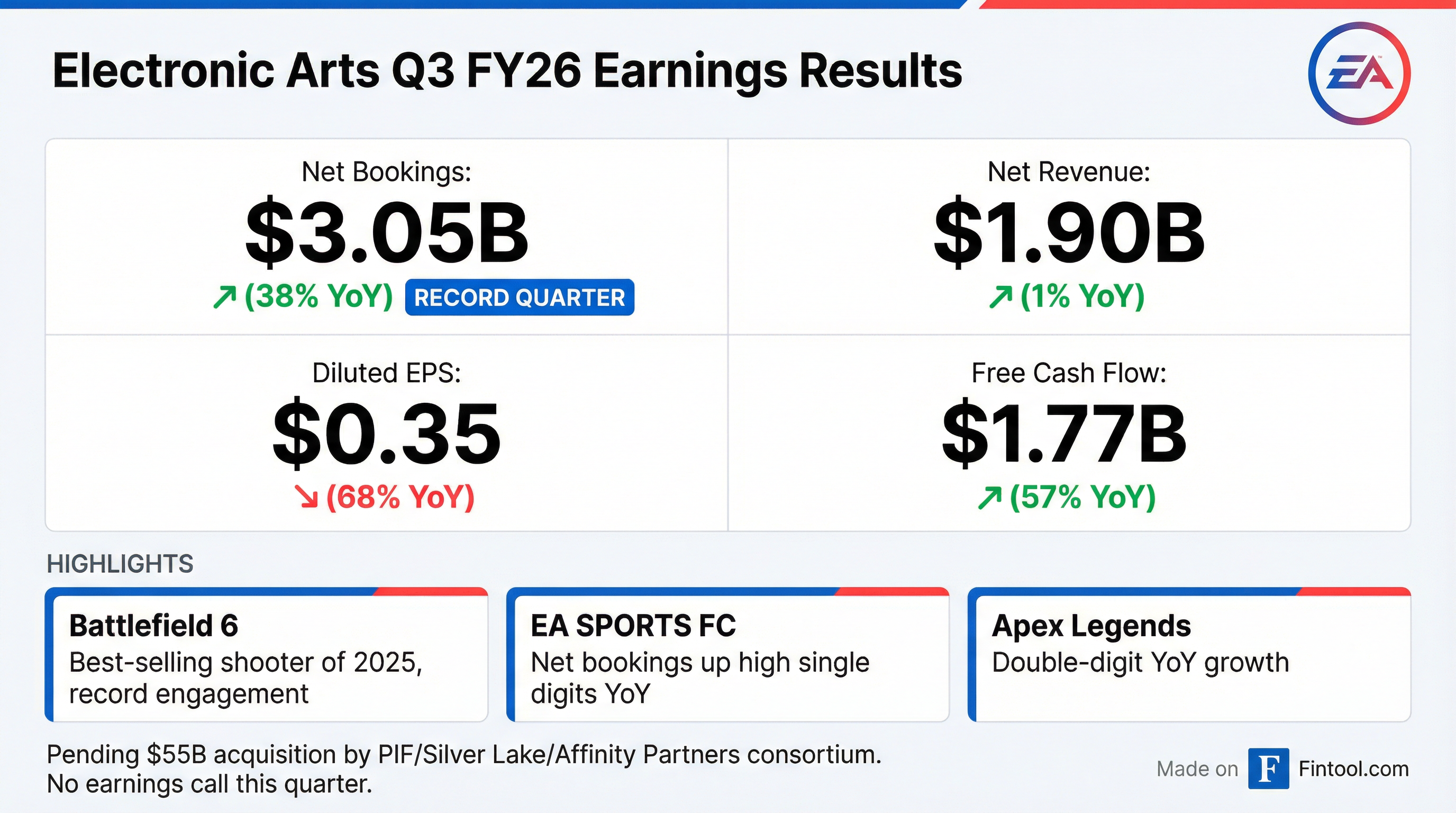

EA Posts Record $3B Net Bookings on Battlefield 6 Launch, But EPS Drops 68%

February 3, 2026 · by Fintool AI Agent

Electronic Arts delivered a record-breaking quarter for net bookings—the company's preferred operating metric—reaching $3.05 billion, up 38% year-over-year, driven by Battlefield 6's landmark launch as the best-selling shooter of 2025 . However, GAAP net income plummeted 70% to $88 million and diluted EPS fell to $0.35 versus $1.11 in the prior year period . EA did not host an earnings call this quarter due to its pending $55 billion acquisition .

Did EA Beat Earnings?

EA's Q3 FY26 results present a mixed picture depending on which metric you prioritize:

The divergence between record net bookings and declining profitability stems from deferred revenue timing. Net bookings includes $1.145 billion in deferred revenue from new game launches (primarily Battlefield 6) that will be recognized in future quarters . Meanwhile, operating expenses surged—R&D up 16%, marketing and sales up 42%, and G&A up 13%—driven by the Battlefield 6 launch and acquisition-related costs .

What Drove the Record Quarter?

Three franchises powered EA's performance:

Battlefield 6 — The marquee release of the quarter. Battlefield 6 was the best-selling shooter title of 2025 and set new franchise engagement records . This drove a massive $1.145B swing in deferred revenue as players purchased the game and in-game content that will be recognized over time.

EA SPORTS FC — Net bookings increased high single digits year-over-year in Q3, excluding deluxe edition content timing benefits, driven by strength in Ultimate Team and FC Mobile .

Apex Legends — Momentum continued with net bookings up double-digits year-over-year, driven by innovative new features and events .

What Changed From Last Quarter?

The sequential improvement in net bookings reflects Battlefield 6's October launch. The decline in GAAP operating margin (from 10.9% to 6.7%) is primarily driven by launch-related marketing spend and acquisition costs—$53M in acquisition-related expenses this quarter versus $26M a year ago .

Revenue Mix: Platform and Composition

By Composition

Full game revenue grew 6% on Battlefield 6's success, while live services were flat year-over-year despite strength in FC and Apex Legends.

By Platform

PC platform surged 19% on Battlefield 6 strength, while console and mobile faced year-over-year headwinds.

How Did the Stock React?

EA shares closed at $201.39 on February 3, 2026, down 1.2% on the day . The muted reaction likely reflects:

- Acquisition overhang — With the $55B deal expected to close in Q1 FY27, the stock trades near the implied deal price

- Mixed signals — Record bookings offset by EPS decline

- No forward guidance — EA withdrew guidance amid the pending transaction

The $55 Billion Elephant in the Room

On September 29, 2025, EA announced a definitive agreement to be acquired by a consortium comprising The Public Investment Fund (Saudi Arabia's sovereign wealth fund), Silver Lake, and Affinity Partners in an all-cash transaction valuing EA at approximately $55 billion enterprise value . The transaction is expected to close in Q1 FY27 (April-June 2026) and is subject to regulatory approvals.

Key implications:

- No earnings call this quarter — management is not providing forward commentary

- Stock buybacks paused — no repurchases in Q3 vs $375M in Q3 FY25

- Dividend maintained — $0.19 quarterly dividend declared, payable March 18, 2026

Cash Flow and Balance Sheet

EA generated strong cash flow despite the earnings decline:

Operating cash flow surged 55% year-over-year to $1.83B, driven by the $1.16B increase in deferred revenue from game launches.

The $790M increase in deferred revenue (from $1.7B to $2.49B) represents future revenue from Battlefield 6 and other game launches that will be recognized over time.

Historical EPS Trend

EPS has declined for three consecutive quarters as EA invested heavily in the Battlefield 6 launch and incurred acquisition-related costs. The earnings trajectory will normalize as deferred revenue from the record bookings quarter is recognized.

Key Risks and Considerations

- Acquisition uncertainty — Regulatory approvals still pending; any delay or failure to close would significantly impact the stock

- Margin pressure — GAAP operating margin declined to 6.7% from 20.0% a year ago

- Integration risks — Post-close execution under new ownership remains uncertain

- Live services dependency — 67% of revenue from live services; any engagement decline would be material

Forward Catalysts

- Q1 FY27 deal close (expected April-June 2026) — The consortium's $55B acquisition is the primary catalyst

- Battlefield 6 revenue recognition — Deferred revenue unwind will boost reported earnings in coming quarters

- Title slate — skate. and additional titles in development for future launch

Electronic Arts reported Q3 FY26 results on February 3, 2026. The company did not host an earnings call due to its pending acquisition. For more details, see EA's 8-K filing and investor relations website.